Posts Tagged ‘economy’

Posted by Richard on January 9, 2016

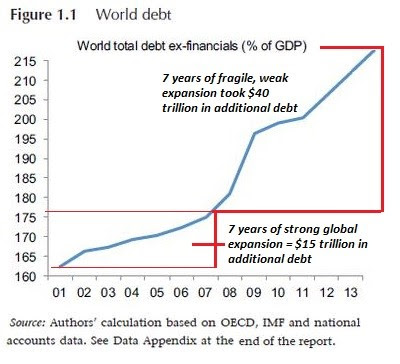

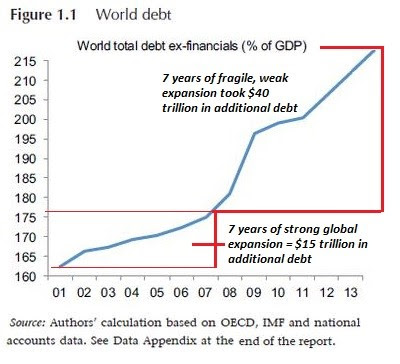

Charles Hugh Smith has an interesting post about how the world-wide orgy of “stimulus” spending, with money created by expanding debt, is working (emphases in original):

We can summarize the official “solution” to the Global Financial Meltdown of 2008 in one line: borrow and blow trillions–of yen, yuan, dollars, euros, reals, you name it.

The goal of borrowing and blowing trillions was to re-invigorate “growth”— any kind of “growth,” no matter how wasteful, unproductive or even counter-productive it might be: wars, nation-building, ghost cities, needless MRIs, useless college diplomas, bridge to nowhere–anything the borrowed money was squandered on counts as “growth” in the Keynesian status quo.

Unsurprisingly, this strategy yields diminishing returns as the negative returns on all this debt-fueled spending piles up. While the yield on the “investment” is either negative or only fleetingly positive, the interest due on the debt is forever. That’s the source of diminishing returns in a nutshell.

Here’s one of the graphs illustrating the point, but go read the whole thing.

Posted in Uncategorized | Tagged: debt, diminishing returns, economics, economy, finance, spending, stimulus | Leave a Comment »

Posted by Richard on March 28, 2014

At The Economist, someone identified only as R.A. wants the world’s central bankers to work harder at increasing inflation. I think it’s Paul Krugman writing anonymously.

Alone among big rich economies, Japan is now actively trying to raise inflation, in hopes of finally kicking its low rate, low growth habit. Higher inflation is the only reasonable way forward:

This would let central banks cut effective borrowing costs despite the zero bound on interest rates, since inflation reduces the burden of repaying a given loan. Just as important, higher inflation would speed up interest-rate normalisation.

…

…

The rich world’s central banks are behaving with a dangerous complacency. Low and falling inflation will retard ongoing recoveries. …

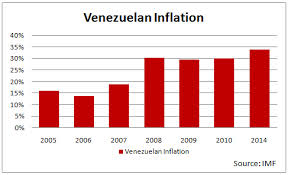

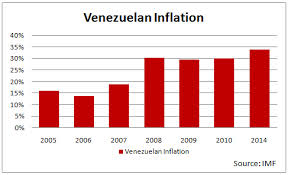

If low inflation retards economic growth, then Venezuela’s economy must be growing like crazy:

Posted in Uncategorized | Tagged: economics, economy, inflation, keynesianism | Leave a Comment »

Posted by Richard on March 15, 2014

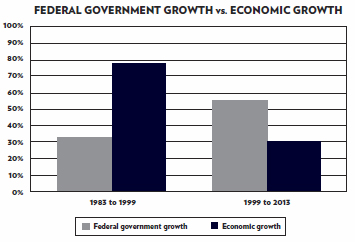

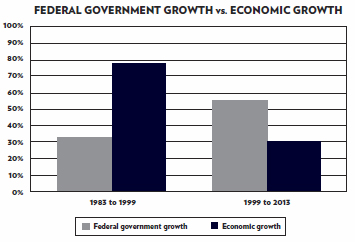

In a recent Cato Policy Report, Brian Domitrovic contrasted the growth of government in the past 15 years with the comparable period before that, and suggested that what this country needs is another tax revolt:

For about 15 years now, the federal government, in all its myriad activities, has been in major expansion mode. The Federal Reserve, the regulatory apparatus, the tax code, the police and surveillance machinery of the state — all of these extensions of the government have broadened their reach, power, and ambition in significant fashion since the late 1990s.

The basic metric that reflects all this is the level of federal spending. In 2013 the government of the United States spent 55 percent more money — in real, inflation-adjusted terms — than it did in 1999. Economic growth in that 14-year span has been 30 percent. …

…

The moment is apt, then, to reclaim a tradition of our recent history, a tradition that the big-government 21st century is striving to suppress. This is the great successful effort to slow Leviathan of a generation and a half ago — the effort that gave us the Ronald Reagan revolution of the 1980s.

By all means, read the whole thing. But this graph clearly illustrates one of the key points:

Posted in Uncategorized | Tagged: big government, economics, economy, reagan, tax cuts | Leave a Comment »

Posted by Richard on September 14, 2012

Mark J. Perry has evidence showing that Ben Bernanke developed certain proclivities early in life which remain with him to this day.

🙂

Posted in Uncategorized | Tagged: bernanke, economy, inflation | Leave a Comment »

Posted by Richard on August 2, 2012

Pretty much everyone agrees that the financial crisis of 2008 was precipitated by the collapse of the housing bubble and subprime mortgages.

The left blames “predatory lenders” who somehow coerced or swindled borrowers into signing up for mortgages they couldn’t afford.

The right blames government regulations and intimidation, corruption and irresponsible practices at Fanny Mae and Freddie Mac, and lawsuits and intimidation from non-profits like ACORN for pressuring banks and mortgage institutions into making countless bad loans, which they then turned into CDOs and other derivative instruments in a futile attempt to avoid the consequences.

Unlike the left, which has only demagoguery and accusations, the right has facts to support its view. See also this and especially this.

But in any case, everyone pretty much agrees that vast numbers of loans to borrowers who would never be able to repay them were the root of the problem.

So why is the Obama administration trying to coerce lenders into making vast numbers of loans to borrowers who will never be able to repay them?

Well, this time it’s different. Because this time it’s not Fannie Mae, Freddie Mac, and the Community Reinvestment Act. This time it’s the Consumer Finance Protection Bureau, a creation of Dodd-Frank (two of the prime architects of the 2008 crisis). This time they’re also going after the credit rating agencies.

And this time the subprime mortgages, lowered credit standards, and liar loans are limited to just blacks and Hispanics. Who will no doubt be protected from the consequences of whatever irresponsible choices they may make by the beneficence of the redistributionist Obama administration (if it continues for another four years).

Or maybe this time it will lead to yet another housing bubble ending in yet another housing collapse leading to yet another round of smaller financial institutions going under or being absorbed by the “too big to fail” institutions that have friends in Washington looking out for them — who will once again be bailed out at the expense of taxpayers who acted responsibly.

Read the whole thing.

Posted in Uncategorized | Tagged: congress, corruption, democrats, economy, obama, regulation | Leave a Comment »

Posted by Richard on July 27, 2012

Congressman Mike Kelly (R-PA3) delivered such a rousing five-minute speech on the floor of the House yesterday that he received a standing ovation. Check it out.

[YouTube link]

Posted in Uncategorized | Tagged: congress, economy, regulation | Leave a Comment »

Posted by Richard on June 8, 2012

The President held a press conference today, and he didn’t do himself any favors re-election-wise. In an incredibly clueless answer to a question about the economy, he argued that “the private sector is doing fine” and the only problem with our economy is that the government sector isn’t big enough. Here’s the key minute:

[YouTube link]

He again called on the Republicans to pass his “Jobs Act,” which he said would create a million new jobs for construction workers, policemen, firemen, and teachers — in other words, more government workers and more workers on government construction projects — and he lamented that fact that governors and mayors weren’t doing enough hiring.

Plenty of Republicans have responded forcefully to this nonsense, including Governors Christie, Jindal, and Walker. I especially liked Jindal’s pithy observation that the Obama administration is “at the nexus of liberalism and incompetence,” and Scott Walker’s summation of the difference between the Socialist Democrats and the rest of us:

“There are two very different views in the country,” Walker said. “The current administration seems to think that success is measured by how many people are dependent on the government. I think success is measured by how many are not.”

To me, there’s a certain irony to Obama’s recent remarks on the economy. In addition to an insufficiently large government sector, he blames our economic problems on the problems of Europe. But this is the man whose quest to “fundamentally transform” America is a quest to make us more like Europe, with its abundantly large government sector. A lot of good that’s done them.

Well, at least the finger-pointing at governors, mayors, and Europe has led to less “blame Bush” rhetoric.

UPDATE: Ever since I heard the President say “the private sector is doing fine,” something in the back of my mind has been bugging me about that statement, but I couldn’t put my finger on what it was. Finally, it came to me — this isn’t the first time I’ve heard almost exactly that phrase. It was last October that Senator Harry Reid (SD-NV) said:

“It’s very clear that private sector jobs have been doing just fine. It’s public sector jobs where we’ve lost huge numbers.”

I’ve got the whole story here.

Posted in Uncategorized | Tagged: big government, demagoguery, economy, obama, politics | 1 Comment »

Posted by Richard on May 29, 2012

A friend who owns a condo showed me the latest condo community association newsletter the other day. An article in it illustrates in a small way why the economy in general and the housing market in particular aren’t going to get healthy as long as the Obama administration is in office.

Because they often attract first-time buyers with limited funds for down payments, condos are frequently financed with FHA loans. Let’s set aside for the moment the issue of whether the FHA program should exist — or needs to. It’s been in place for many years, guaranteeing loans with low down payments. To offset the increased risk, the government requires buyers to carry mortgage insurance until their equity in the property reaches 20%, and there are stricter rules on what properties qualify for an FHA loan.

Apparently for condos, HUD requires the condominium association to apply for FHA certification of its properties. And the process has become much more onerous under the Obama administration. For one thing, in this area as in so many others, the Obama administration has made regulatory uncertainty a way of life, as the newsletter explains (emphasis in original):

In November 2009, the federal government decided to change EVERYTHING with respect to the process and approval requirements for condominium associations only. Then they changed again in February 2011. And again in June 2011. …

Through June 2011, Westwind Management (our management company) was successful in recertifying all of its qualified condominium clients within HUD standards. Now, condominium associations are required to be recertified every two years. This is a time consuming and costly burden that was not necessary before 2009.

But it’s not just constantly changing regulations and burdensome paperwork. The managing agent has to keep HUD informed continuously of any information changes, possible defects, disputes among owners, etc. There are no doubt scores, and perhaps hundreds, of pages of hard-to-understand regulations detailing what the management agent is obligated to provide. And he or she is personally responsible for failure to comply:

The language is vague and the penalties are untenable. The penalty for a fraudulent package or not reporting changes is up to $1,000,000 in fines and/or a maximum of 30 years in prison.

Would you want that job? Or invest in a condo management company in this regulatory climate?

Posted in Uncategorized | Tagged: big government, economy, obama, real estate, regulation | Leave a Comment »

Posted by Richard on May 27, 2012

The Obama campaign continues to hammer Romney for his association with Bain Capital, the private equity firm they portray as a “vampire” that profited from layoffs and plant closures. So Todd Shepherd at Colorado Peak Politics decided to play the ever-popular “sauce for the goose, sauce for the gander” game.

It seems that former Denver mayor Federico Peña, who is again this year (as in 2008) Obama National Campaign Co-chair, is every bit as much a “venture capital vampire” as R0mney. Since 2000, Peña has been a partner in the private equity firm Vestar Capital. Shepherd documented some of the recent Obama campaign contributions of Peña and Vestar managing director James Kelley. Then he highlighted some of Vestar’s layoffs and plant closures at the companies it acquired, like Del Monte Foods and Solo Cup Company.

To his credit, Shepherd pointed out that Vestar Capital isn’t a bunch of “evil corporate raiders.” Neither is Bain Capital. These firms serve a valuable purpose, rescuing ailing companies when they can and redirecting resources to more valued uses when they can’t. Their goal certainly is (and ought to be) to make money. But in the process, they improve the economy and make us all better off.

Inefficient, uncompetitive companies failing and factories shutting down are an essential aspect of economic growth and progress, leading to more wealth and better products, jobs, and living standards for all. If that idea is new or strange to you, read about Joseph Schumpeter’s concept of Creative Destruction.

Posted in Uncategorized | Tagged: economics, economy, obama, politics, romney | Leave a Comment »

Posted by Richard on April 10, 2012

Gov. Chris Christie addressed the George W. Bush Institute’s Conference on Taxes and Economic Growth today and demonstrated again why many of us consider him (despite a few flaws) one of the great statesmen and great communicators in our country today. Human Events’ John Hayward reported some of Christie’s key points:

“I’ve never seen a less optimistic time in my lifetime in this country, and people wonder why,” Christie said. “I think it’s really simple: It’s because government’s now telling them ‘stop dreaming, stop striving, we’ll take care of you.’ We’re turning into a paternalistic entitlement society.”

Christie warned this would bankrupt us both financially and morally, “because when the American people no longer believe that this is a place where only their willingness to work hard, and to act with honor and integrity and ingenuity determines their success in life, then we’ll have a bunch of people sitting on a couch waiting for their next government check.”

If you have only a few minutes, watch this 2:18 video excerpt that includes the above comments.

[YouTube link]

But if you can spare a half hour, I strongly urge you to watch the whole speech (29:28), below. It’s highly entertaining, informative, enlightening, and uplifting. I guarantee it’s well worth your time.

[YouTube link]

John Hayward made an important point. After quoting Dan Bigman’s summary of Christie’s “reaching across the aisle” to get the support of a third of the legislature’s Democrats for addressing a state budget deficit of 30% (!) without raising taxes, he said of Christie’s “constructive compromises”:

…which actually sounds a lot more like “winning the argument” than “compromise,” in the usual mushy bipartisan drop-your-principles potato-cultivating sense our perpetually growing federal government and its attendants use the term. Among other things, Christie stopped a “millionaire tax” in New Jersey, capped property taxes, and called for a sizable growth-oriented income tax cut. Those aren’t the sort of sugar plums Democrats normally have dancing in their heads when they anticipate “compromise” with Republicans.

I’d characterize Christie’s approach as Reaganesque. And I wish Romney, McConnell, Boehner, and the rest of the GOP leadership would watch this speech and think about the lessons to be learned. Gentlemen, the route to victory this November doesn’t depend on pandering to moderates and independents, or watering down your message. It depends on convincing people that this country needs to be turned around. It depends on convincing people that you have a plan to prevent our impending financial and moral bankruptcy. It depends on demonstrating that you’re principled, committed to tackling the tough issues, and sincerely concerned about our country’s future. It would help to have a realistic plan for doing so and be able to present it articulately and persuasively.

Of course, that’s asking a lot of the Republican leadership.

Posted in Uncategorized | Tagged: chris christie, economy, fiscal policy, politics | Leave a Comment »

Posted by Richard on March 31, 2012

The economic recovery isn’t going well in a number of respects, according to Reason’s Tim Cavanaugh. Americans are earning less (after taxes and inflation) and spending more. So borrowing has increased and saving has collapsed. The cheerleaders for the Obama administration and the Bernanke Fed at CNN think this is good news.

Of course it is. Any farmer will tell you that the way to ensure bigger harvests in the future is to eat some of your seed corn.

Posted in Uncategorized | Tagged: bernanke, debt, economy, monetary policy, obama, saving, spending | Leave a Comment »

Posted by Richard on February 16, 2012

Gresham’s Law has a sobering graphical history of the Federal Reserve System’s assets from 1915 to 2012. Here’s Tom Gresham’s introduction:

Here we present a history of the Fed in charts. As you’ll surely glean from the below — the Fed has degenerated from a by and large passive institution (dealing only in high-quality self-liquidating commercial paper and gold) to an active pursuant of junk, an enabler of wars, a ‘benevolent’ combatant of the depressions of its own creation, a central planner of employment & prices and of course a forgiving friend to inconvenient market follies.

The first graph, showing the entire 97-year history, is a hockey stick if there ever was one. And unlike Mann’s bogus global warming hockey stick, it’s not based on jiggering the data.

There are only two possible endgames: default or devaluation of the currency. My money’s on the latter.

Posted in Uncategorized | Tagged: debt, economy, federal reserve, inflation | Leave a Comment »

Posted by Richard on February 15, 2012

According to Investor’s Business Daily, it’s not just the rich who’ll pay for the massive expansion of government envisioned by the latest Obama budget (no surprise; it can’t be just the rich because there aren’t enough rich people). And, typically, the administration is looking for an international way to cram their plans down America’s throat (emphasis added):

Discussing President Obama’s new budget, Gene Sperling, the White House’s top economist, said “we need a global minimum tax” so no one escapes paying “their fair share.”

This idea is not just bad; it’s likely unconstitutional. In any event, it starkly reveals the underlying premise behind Obama’s latest budget plan: To hike taxes massively on all Americans to pay for an unprecedented expansion of federal government.

…

To pay for it, the president and his aides are using class-warfare to build a case for a big tax hike on “the rich.” But beware: The Obama budget includes a $2.8 trillion jump in total taxes over the next 10 years, $1.5 trillion coming from income taxes alone. That amount is so large it can’t come solely from the well-off. It will require huge new taxes on all Americans.

…

Americans for Tax Reform has just totaled up the tax increases in Obama’s budget. It makes for scary reading:

• ObamaCare alone includes 20 separate tax hikes.

• Tax rates on most small businesses are expected to go up to 39.6% from 35%.

• Tax rates on capital gains, the fuel for economic and job growth, will jump to 23.8% from 15%.

• Rates on dividends surge to 43.4% from 15%.

• The death tax will jump to 45% from 35%.

• Large businesses will take a job-killing $147 billion tax hit as the U.S. double-taxes overseas profits.

• Families will pay a $100 billion energy tax over the next decade as oil, gas and coal companies get hit with new levies that they will simply pass on to consumers.

• The proposed new “Buffett Tax” will hit wealthy Americans with a marginal tax rate of 90% or higher.

Such massive tax increases will cripple the American economy, retarding economic growth and ensuring high unemployment for the next decade. It’s hard to imagine that all the brilliant Ivy-league-educated people in the Obama administration don’t understand that. Either that’s their goal — to preside over the decline of America, to diminish this country — or they simply don’t care as long as their redistributionist goals are achieved.

The current administration and the Democratic Party leadership are going to destroy this country in the name of egalitarianism if they aren’t stopped. If only there were an opposition party leadership and an opposition party presidential candidate capable of passionately, articulately, and with conviction making that point and offering an alternative of freedom, opportunity, limited government, and individual sovereignty. If only there were someone capable of contrasting their own vision of a “shining city on the hill” with the grim future of dependence and shared poverty offered by the leftists/progressives. If only there were another Reagan.

Posted in Uncategorized | Tagged: big government, economy, obama, taxes | 1 Comment »

Posted by Richard on January 28, 2012

If you’re not concerned about inflation, a set of graphs at The Big Picture may change your mind. They show the balance sheets of the world’s eight largest central banks: the European Central Bank (ECB), the Federal Reserve (Fed), the Bank of Japan (BoJ), the Bank of England (BoE), the Bundesbank (Germany), the Banque de France, the People’s Bank of China (PBoC) and the Swiss National Bank (SNB). They were posted by James Bianco of Bianco Research, who summed up the information succinctly in the first sentence of his post:

The degree to which central banks around the world are printing money is unprecedented.

…

The combined size of these eight central banks’ balance sheets has almost tripled in the last six years from $5.42 trillion to more than $15 trillion and is still on the rise!

…

Prior to the 2008 financial crisis, the eight central bank balance sheets were less than 15% the size of world stock markets and falling. In the immediate aftermath of Lehman Brothers’ failure, these eight central bank balance sheets swelled to 37% the capitalization of the world stock market. But keep in mind that the late 2008/early 2009 peak was due to collapsing stock market values combined with balance sheet expansion via “lender of last resort” loans.

Recently, the eight central bank balance sheets have spiked back to 33% of world stock market capitalization. This has come about not by lender of last resort loans, but rather by QE expansion (buying bonds with “printed money“) even faster than world stock markets are rising.

So how long can these eight helicopters keep dropping trillions of dollars in newly printed money all over the world before we need a wheelbarrow-full to buy a few days’ groceries? No one knows. But if ever there was an argument for fleeing to hard assets (gold, silver, platinum, …), these charts are it. Sometime down the road, gold at $1700 per ounce is going to look like a bargain.

Posted in Uncategorized | Tagged: economy, gold, inflation | Leave a Comment »

Posted by Richard on December 31, 2011

Mark Steyn doesn’t think much of how the U.S. spent 2011, and he’s less than optimistic about 2012:

… The year began with a tea-powered Republican caucus taking control of the House of Representatives and pledging to rein in spendaholic government. It ended with President Obama making a pro forma request for a mere $1.2 trillion increase in the debt ceiling. This will raise government debt to $16.4 trillion — a new world record! If only until he demands the next debt-ceiling increase in three months’ time.

At the end of 2011, America, like much of the rest of the western world, has dug deeper into a cocoon of denial. Tens of millions of Americans remain unaware that this nation is broke — broker than any nation has ever been.

…

Public debt has increased by 67% over the last three years, and too many Americans refuse even to see it as a problem. For most of us, “$16.4 trillion” has no real meaning, any more than “$17.9 trillion” or “$28.3 trillion” or “$147.8 bazillion.” It doesn’t even have much meaning for the guys spending the dough.

Look into the eyes of Barack Obama or Harry Reid or Barney Frank, and you realize that, even as they’re borrowing all this money, they have no serious intention of paying any of it back. That’s to say, there is no politically plausible scenario under which the $16.4 trillion is reduced to $13.7 trillion, and then $7.9 trillion, and eventually 173 dollars and 48 cents.

At the deepest levels within our governing structures, we are committed to living beyond our means on a scale no civilization has ever done. Our most enlightened citizens think it’s rather vulgar and boorish to obsess about debt. The urbane, educated, Western progressive would rather “save the planet,” a cause which offers the grandiose narcissism that, say, reforming Medicare lacks.

Read the whole thing.

Posted in Uncategorized | Tagged: budget, debt, deficit, economy | 1 Comment »