Diminishing returns

Posted by Richard on January 9, 2016

Charles Hugh Smith has an interesting post about how the world-wide orgy of “stimulus” spending, with money created by expanding debt, is working (emphases in original):

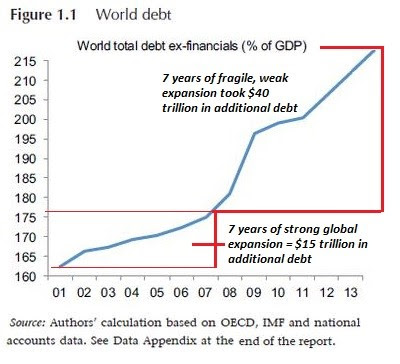

We can summarize the official “solution” to the Global Financial Meltdown of 2008 in one line: borrow and blow trillions–of yen, yuan, dollars, euros, reals, you name it.The goal of borrowing and blowing trillions was to re-invigorate “growth”— any kind of “growth,” no matter how wasteful, unproductive or even counter-productive it might be: wars, nation-building, ghost cities, needless MRIs, useless college diplomas, bridge to nowhere–anything the borrowed money was squandered on counts as “growth” in the Keynesian status quo.Unsurprisingly, this strategy yields diminishing returns as the negative returns on all this debt-fueled spending piles up. While the yield on the “investment” is either negative or only fleetingly positive, the interest due on the debt is forever. That’s the source of diminishing returns in a nutshell.

Here’s one of the graphs illustrating the point, but go read the whole thing.

Subscribe To Site:

Leave a Comment